Short Put Calendar Spread - Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web in this video i have explained about short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

Short Calendar Put Spread Staci Elladine

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Web in this video i have explained about short put calendar spread. Web a short put spread, or.

Calendar Put Spread Options Edge

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of spread that uses two.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option with a.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

Web in this video i have explained about short put calendar spread. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a short put calendar spread is another type of spread that uses two different put options. Web in this video i have explained about short put calendar spread. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web a short calendar.

Advanced options strategies (Level 3) Robinhood

Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short calendar spread with puts realizes.

Short Put Calendar Spread Options Strategy

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web in this video i have explained about short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a.

Short Put Calendar Spread

Web in this video i have explained about short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy,.

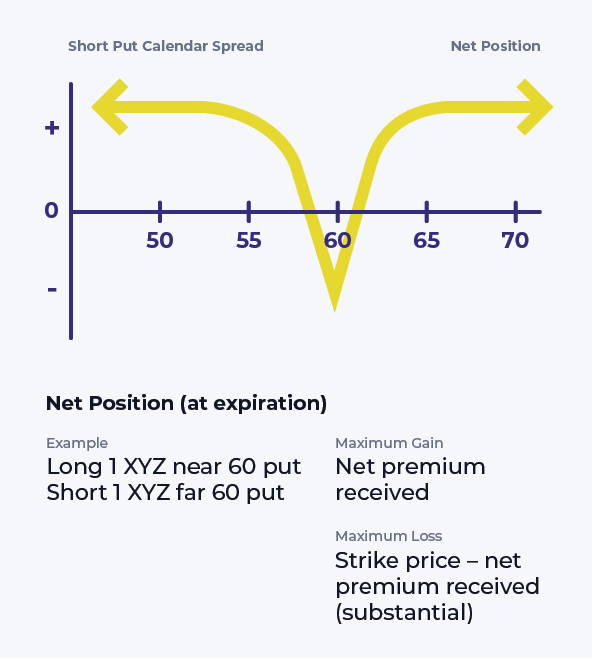

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web in this video i have explained about short put calendar spread. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web a short put calendar spread is another type of spread that uses two different put options. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on.

Web A Short Put Calendar Spread Is Another Type Of Spread That Uses Two Different Put Options.

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a short calendar spread with puts realizes its maximum profit if the stock price is either far above or far below the strike price on. Web a short put spread, or bull put spread, is an advanced vertical spread strategy with an obligation to buy and a right to sell at two. Web in this video i have explained about short put calendar spread.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)